Salary Slip, often referred to as pay slips, are vital documents that provide detailed information about an employee’s earnings and deductions. Understanding salary slips is crucial for employees to ensure transparency in their compensation and financial planning. In this comprehensive guide, we’ll unravel the mysteries of salary slips, exploring their significance, components, and common questions.

What is the Salary Slip or Pay Slip?

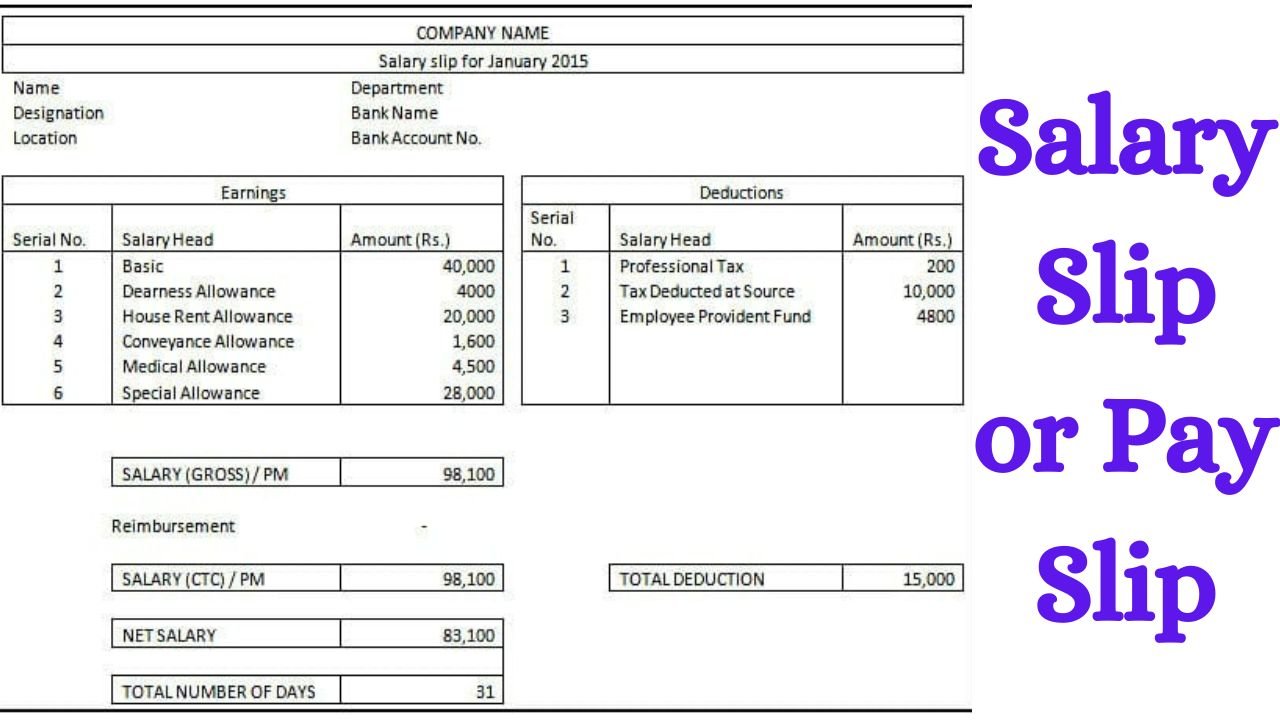

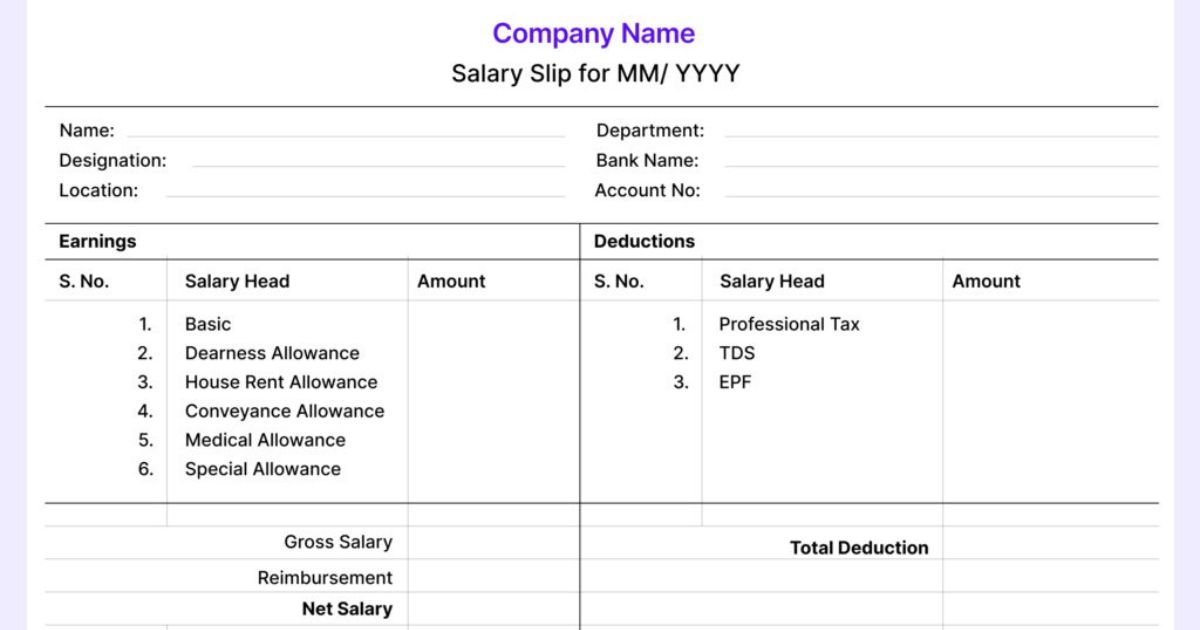

A Salary Slip or Pay Slip, is a document provided by employers to employees, detailing their earnings and deductions for a specific pay period. It serves as a record of financial transactions related to an employee’s compensation, including wages, bonuses, taxes, and deductions.

Why are Salary Slips Important?

Salary Slip or Pay Slip play a pivotal role in maintaining transparency and accountability in the employer-employee relationship. They provide employees with a clear breakdown of their earnings, ensuring they are fairly compensated for their work. Additionally, salary slips serve as proof of income for various purposes, such as applying for loans, renting accommodations, or filing taxes.

Key Components of a Salary Slip

Understanding the components of a salary slip is essential for deciphering its contents accurately. Here are the key elements typically found on a salary slip:

Employee Information

- Name

- Employee ID

- Department

- Date of Issue

Earnings

- Basic Salary

- Allowances (Housing, Transport, etc.)

- Overtime Pay

- Bonuses

- Commissions

Deductions

- Income Tax

- Social Security Contributions

- Pension Contributions

- Health Insurance Premiums

- Loan Repayments

Net Pay

- Total Earnings After Deductions

The Importance of Salary Slips for Employees

Salary slips serve as more than just a record of earnings; they empower employees to advocate for fair compensation and financial stability. By understanding the components of their salary slips, employees can make informed decisions about their finances and ensure compliance with labor laws and regulations.

Common FAQs About Salary Slips

1. What is included in the basic salary?

- The basic salary comprises the fixed amount of money paid to an employee before any additional allowances or bonuses.

2. How are taxes calculated on a salary slip?

- Taxes are calculated based on the employee’s taxable income, which includes their basic salary, allowances, and any additional earnings subject to taxation.

3. Can allowances vary from one payslip to another?

- Yes, allowances such as housing or transport allowances may vary depending on factors such as company policies or changes in employment conditions.

4. What deductions are typically included on a salary slip?

- Deductions may include income tax, social security contributions, pension contributions, health insurance premiums, and loan repayments, among others.

Conclusion

Salary slips are more than just paperwork; they are essential tools for ensuring transparency, accountability, and fair compensation in the workplace. By understanding the components of their salary slips and asking the right questions, employees can advocate for their financial well-being and make informed decisions about their earnings.